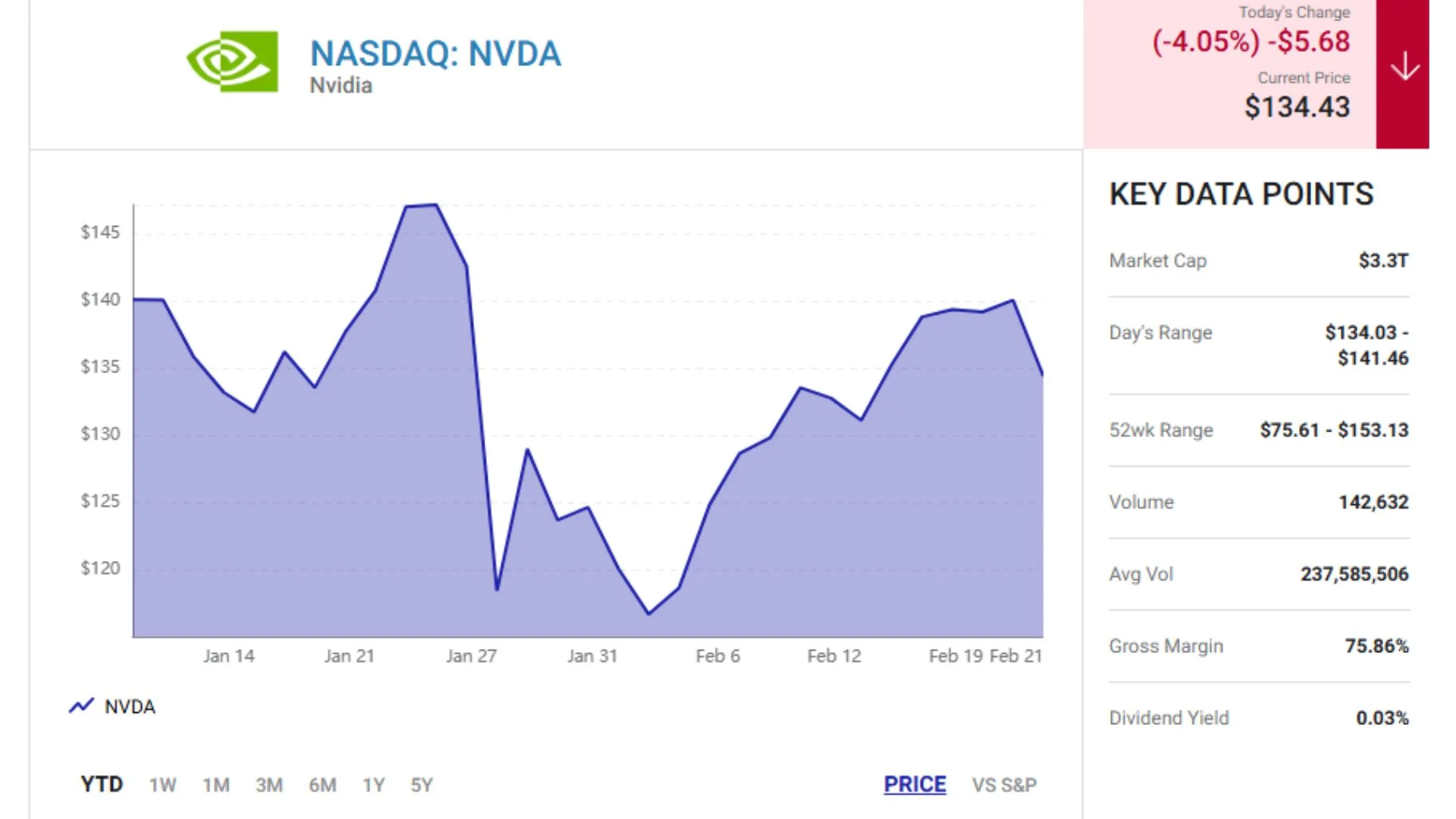

Nvidia (NVDA -4.05%) is likely the most closely watched stock in the world right now. Having surged an astonishing 800% over the past two years, many investors and analysts believe that the stock still has significant potential for further growth. This optimism is primarily due to the company’s leading position in one of today’s most promising sectors: artificial intelligence (AI).

This technology giant is the global leader in the AI chip market and has developed a comprehensive ecosystem of related AI products and services. Many of the world’s largest tech companies have turned to Nvidia continuously for access to these powerful tools. As a result, demand has surged, leading to significant earnings growth. Nvidia has reported double- and triple-digit revenue growth in recent quarters, maintaining high profitability, with a gross margin exceeding 70%.

Now, as we head toward Nvidia’s next catalyst — the fourth-quarter and fiscal full-year 2025 earnings report on Feb. 26 — I predict the stock is set to surge for the following three reasons. Let’s check them out.

1. The initial results from the Blackwell rollout appear to be promising.

All eyes are on Nvidia’s next earnings report, and for good reason. This quarter marks the debut of their groundbreaking Blackwell architecture, a game-changer in the artificial intelligence and high-performance computing space. The Blackwell platform, featuring seven distinct AI chips and advanced networking solutions, is designed for unparalleled performance, efficiency, and security. The buzz around Blackwell is immense, with demand significantly outstripping supply. Investors and tech enthusiasts alike are eager to see how this innovation translates into revenue growth and market share. This earnings release will be a crucial indicator of Nvidia’s continued leadership in the AI chip market and the broader semiconductor industry.

This overwhelming demand fuels my optimism for Nvidia’s upcoming report on the Blackwell rollout. For months, Nvidia has consistently emphasized the robust appetite for its AI solutions, with CEO Jensen Huang himself describing the demand as “insane” in a recent CNBC interview. 1 This clear and vocal acknowledgment of market excitement signals that customers, including major players in data centers, cloud computing, and AI development, are not only eager to adopt the Blackwell architecture but also prepared to navigate potential supply constraints. The sheer volume of pre-orders and expressed interest underscores the platform’s perceived value and positions Nvidia for significant revenue growth in the AI hardware sector. Investors will be closely watching to see how Nvidia manages this unprecedented demand and translates it into concrete financial results, further solidifying its dominance in the accelerated computing landscape.

Adding to the positive outlook, Nvidia’s recent earnings call revealed enhanced visibility into its supply chain, paving the way for a significant revenue surge. The company now anticipates surpassing its initial forecast of several billion dollars in Blackwell architecture revenue during the fourth quarter. 1 This improved supply outlook is crucial for meeting the surging demand for Nvidia’s AI chips and accelerated computing platforms. By addressing potential supply bottlenecks, Nvidia aims to capitalize on the market’s strong appetite for its innovative AI solutions, further solidifying its position as a leader in the semiconductor industry. This increased supply capacity, coupled with the “insane” demand mentioned by CEO Jensen Huang, positions Nvidia to deliver exceptional financial results and drive further growth in the rapidly expanding AI market.

So, considering these clues, I’m expecting more positive updates from the Blackwell launch.

2. The DeepSeek news hasn’t caused lasting damage.

Last month, Chinese start-up DeepSeek announced that it had trained a model using Nvidia’s lower-priced chips and spent only $6 million — which sparked speculation tech giants would follow the example and decrease their AI budgets. And if these major Nvidia customers were to go for the cheaper chips, Nvidia would see a decline in revenue.

Though Nvidia’s stock fell about 16% in one trading session, the stock since has been on the path to recovery. And various pieces of evidence show the news isn’t set to cause lasting damage.

First, it’s important to note that we’re not even completely sure about how much DeepSeek actually spent. Consultant SemiAnalysis estimates DeepSeek invested more than $500 million for chips alone. So, without a clear picture of the investment involved, it’s unlikely market leaders will follow DeepSeek.

Second, these giants — such as Meta Platforms and Alphabet — recently reiterated their AI spending plans and continue to invest aggressively. On top of this, Wedbush’s Dan Ives recently checked in with Nvidia customers, and none had altered their spending plans or AI strategies.

So, the news that weighed on Nvidia stock a few weeks ago looks like a thing of the past — and shouldn’t hurt demand for the stock.

3. Nvidia stock looks like a bargain.

Nvidia stock, after the recent declines, now is trading for about 31x forward earnings estimates — down from more than 50x just a few weeks ago. Even at higher valuations, Nvidia made an interesting long-term buy, considering the company’s market leadership and expansion into a vast array of AI products and services. So, at today’s valuation, the company truly looks like a bargain.

And at this level, Nvidia clearly could attract a broad range of investors, especially if the company delivers positive news during the upcoming earnings report. That’s another reason why I predict Nvidia stock will soar after Feb. 26.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $823,858!*